The Only Guide for Hsmb Advisory Llc

The Only Guide for Hsmb Advisory Llc

Blog Article

The 7-Second Trick For Hsmb Advisory Llc

Table of ContentsHsmb Advisory Llc - The FactsThe Definitive Guide for Hsmb Advisory LlcAn Unbiased View of Hsmb Advisory LlcThe Of Hsmb Advisory Llc

Life insurance policy is particularly important if your household is reliant on your salary. Sector specialists recommend a policy that pays out 10 times your yearly income. These might consist of home loan payments, superior car loans, credit score card financial obligation, taxes, child treatment, and future university prices.Bureau of Labor Data, both spouses worked and generated income in 48. 9% of married-couple family members in 2022. This is up from 46. 8% in 2021. They would be most likely to experience financial difficulty as a result of one of their breadwinner' fatalities. Medical insurance can be gotten with your company, the federal medical insurance market, or exclusive insurance you buy for yourself and your household by getting in touch with health and wellness insurance coverage companies directly or undergoing a medical insurance agent.

2% of the American population lacked insurance coverage in 2021, the Centers for Disease Control (CDC) reported in its National Facility for Health And Wellness Stats. Greater than 60% obtained their coverage via a company or in the private insurance policy market while the remainder were covered by government-subsidized programs including Medicare and Medicaid, veterans' benefits programs, and the government market established under the Affordable Treatment Act.

The Best Guide To Hsmb Advisory Llc

If your earnings is low, you may be one of the 80 million Americans who are eligible for Medicaid.

According to the Social Security Administration, one in 4 employees getting in the labor force will come to be disabled prior to they get to the age of retired life. While health insurance policy pays for hospitalization and medical costs, you are often burdened with all of the expenditures that your paycheck had covered.

Several plans pay 40% to 70% of your income. The cost of disability insurance coverage is based on many elements, consisting of age, way of living, and health.

Numerous plans call for a three-month waiting period prior to the protection kicks in, offer a maximum of three years' worth of protection, and have substantial policy exclusions. Here are your alternatives when purchasing vehicle insurance policy: Obligation protection: Pays for residential property damages and injuries you trigger to others if you're at fault for a crash and also covers lawsuits prices and judgments or negotiations if you're taken legal action against since of a vehicle mishap.

Comprehensive insurance covers burglary and damages to your vehicle as a result of floods, hail, fire, vandalism, falling objects, and animal strikes. When you finance your automobile or lease an automobile, this kind of insurance policy is necessary. Uninsured/underinsured vehicle driver (UM) coverage: If a without insurance or underinsured chauffeur strikes your lorry, this coverage spends for you and your traveler's clinical costs and may likewise account for lost earnings or compensate for discomfort and suffering.

Company protection is usually the very best choice, yet if that is unavailable, get quotes from several providers as numerous offer discounts if you purchase more than one kind of protection. (https://www.taringa.net/hsmbadvisory/health-insurance-st-petersburg-fl-your-ultimate-guide_5bpkou)

The Of Hsmb Advisory Llc

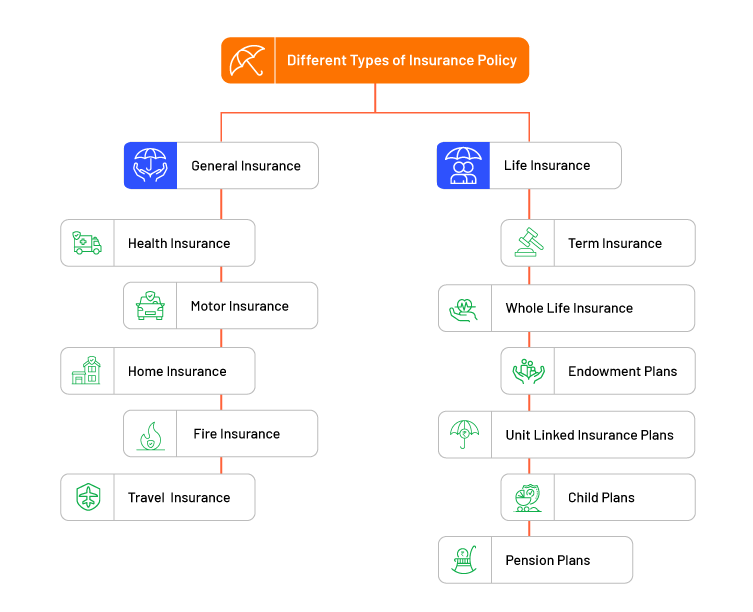

Between medical insurance, life insurance policy, handicap, liability, lasting, and also laptop insurance coverage, the task of covering yourselfand thinking about the limitless possibilities of what can take place in lifecan really feel frustrating. When you comprehend the principles and make sure you're effectively covered, insurance coverage can boost financial confidence and wellness. Below are the most important kinds of insurance policy you need and what they do, plus a pair suggestions to stay clear of overinsuring.

Various states have various regulations, but you can expect health insurance policy (which many individuals obtain through their company), car insurance coverage (if you possess or drive a lorry), and home owners insurance policy (if you own residential property) to be on the checklist (https://www.cheaperseeker.com/u/hsmbadvisory). Necessary sorts of insurance coverage can change, so look into the most up to date legislations every now and then, especially before you restore your plans

Report this page